The paradox keeping finance and IT leaders up at night: Why are new devices getting more expensive while your current ones are worth less every day?

We’re witnessing something unusual in the device market. While budget devices keep prices somewhat stable, the business-grade hardware you actually deploy—premium smartphones, enterprise laptops, professional-grade tablets—continues climbing. The average price across all smartphone tiers is projected to hit $330 by 2029, but your iPhone 17 Pro or Galaxy S25 Ultra? Those are already pushing $1,200-$2,000. Laptops are following suit with projected 6-7% increases, and AI-capable devices command 10-15% premiums. Factor in potential tariff impacts (we’re talking 26-45% price surges on certain devices), and the cost of sitting still suddenly becomes very real.

Meanwhile, that fleet of laptops you purchased during the pandemic? They’ve already lost 40-60% of their value. Your iPhone 15s from last year? Down 58% in trade-in value. And every day you wait, that depreciation curve gets steeper.

So here’s the question every business is wrestling with: Do we hold onto our devices or trade them now?

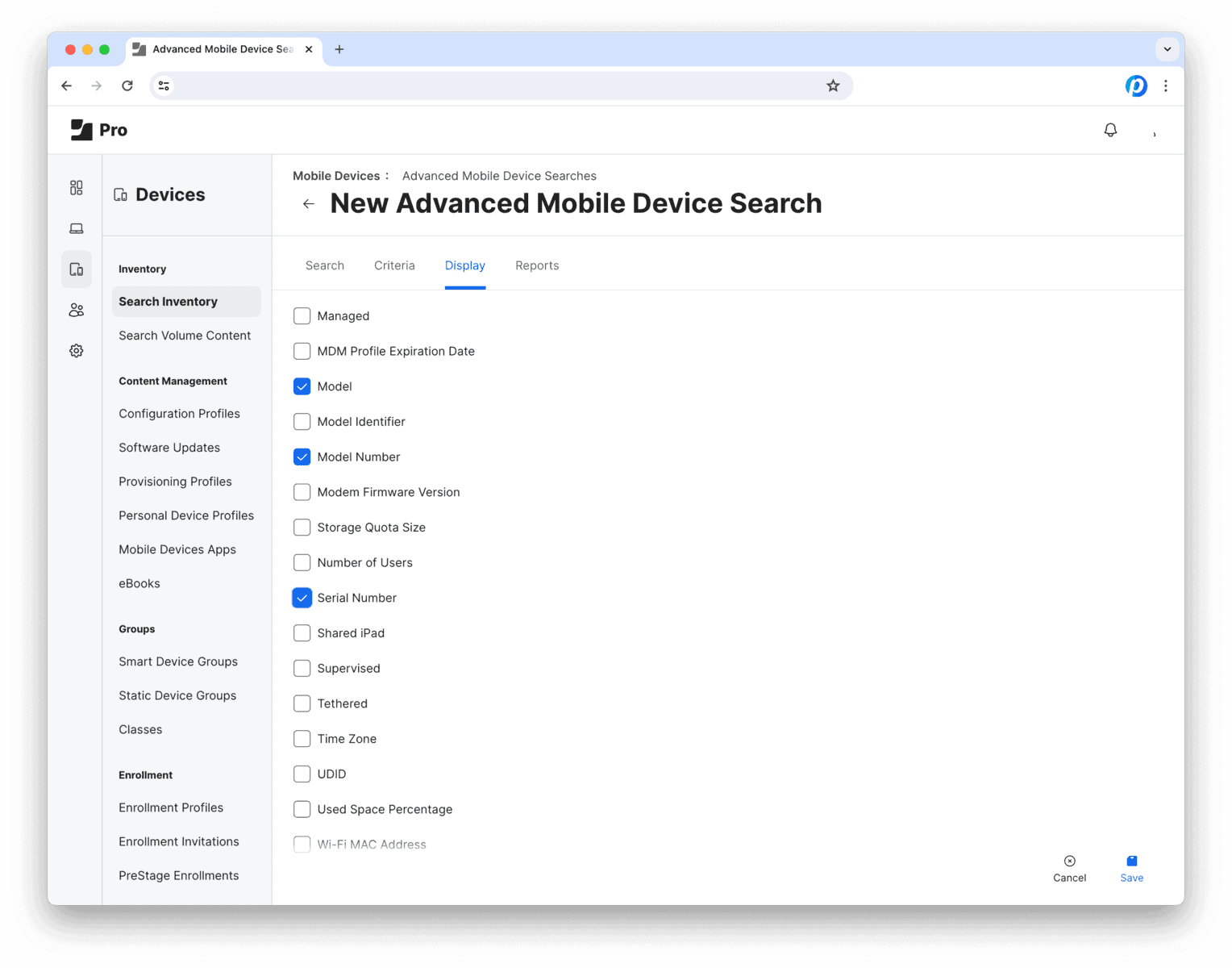

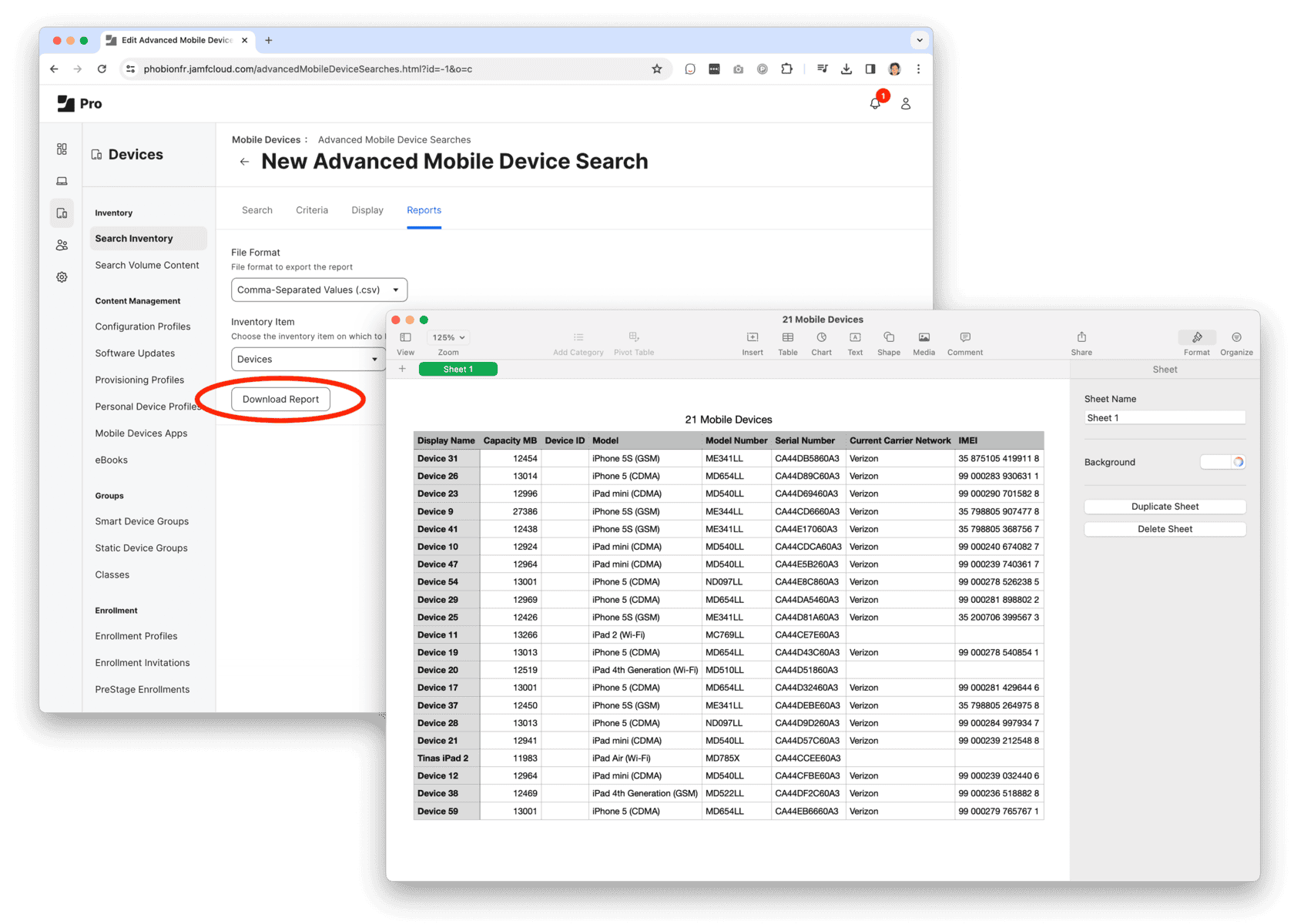

The Inventory Reality Check

Let’s talk about what’s actually sitting in your organization right now:

If you’re like most businesses, you’re carrying:

- Devices purchased during the 2020-2021 COVID boom (now hitting the 3-5 year replacement window)

- A mix of aging smartphones and laptops that are functionally “fine” but technologically outdated

- An average device inventory that’s older than your standard refresh cycle suggests it should be

The data tells a compelling story: consumer smartphone replacement cycles have stretched to 2.67 years and are projected to hit 2.87 years by 2027. Businesses typically operate on 3-5 year cycles. But here’s the catch—extending device life might save capital today, but it’s costing you in depreciation, productivity, and security risk.

And then there’s the October 2025 deadline: Windows 10 end of support. For many organizations, that’s not just a software issue—it’s a hardware mandate.

Certainty vs. Uncertainty: Why Timing Matters More Than Ever

In stable markets, device management is straightforward math. But 2025 isn’t offering stability—it’s offering volatility:

The uncertainty factors:

- Tariff policies that could add hundreds to device costs overnight

- Supply chain pressures creating inventory constraints

- Inflation driving steady price increases across all device categories

- Geopolitical factors affecting component availability

What you CAN control:

- When you capture trade-in value (before or after the next model release)

- How much of your current device equity you recover

- Whether you proactively manage replacement or reactively respond to failures

Here’s the insight most finance teams miss: Device depreciation isn’t linear—it’s event-driven. iPhones lose their steepest value (25-51%) in the first year, with the biggest drops happening right after new model announcements. For businesses holding large device fleets, that’s not just an accounting line item—it’s real capital erosion happening in real time.

The Business Case for Action

Let’s make this concrete with some numbers:

Scenario: 500-device fleet of laptops purchased in 2021 for $750 each

- Original investment: $375,000

- Current estimated trade-in value (4 years old): ~$150,000

- 12 months from now (5 years old): ~$75,000

- Cost of waiting: $75,000 in lost equity

Add to that:

- Increased maintenance costs on aging hardware

- Security vulnerabilities from unsupported systems

- Productivity drain from slower devices

- Emergency replacement costs when devices fail

The question isn’t whether to refresh—it’s whether to do it strategically or reactively.

Three Paths Forward (And What Each One Costs You)

Path 1: Extend Strategically (The “Hold and Optimize” Play)

- Lock in trade-in quotes NOW even if you execute later (values are guaranteed for 30-90 days)

- Identify your 10-20% highest-risk devices and replace those only

- Implement aggressive maintenance and security hardening on remaining fleet

- Set trigger points: when trade-in value drops below X, devices hit age Y, or failures reach Z threshold—you move

- Maximize device lifespan while maintaining a documented exit strategy

- Best for: Organizations with constrained budgets who need to squeeze another 12-18 months from current fleet while staying ready to act

Path 2: Strategic Partial Refresh

- Trade high-value devices before next model cycle

- Refresh critical roles first (field teams, executives, revenue-generating functions)

- Bank trade-in credits while values are still meaningful

- Spread capital expenditure across fiscal quarters

- Best for: Most businesses balancing multiple priorities

Path 3: Aggressive Full Refresh

- Maximize current trade-in values across entire fleet

- Lock in pre-tariff pricing where possible

- Eliminate aged inventory all at once

- Reset to a clean lifecycle management schedule

- Best for: Organizations with capital available and strategic mandate for technology modernization

The Trade-In Advantage: Why This Matters for Every Channel

For Enterprise Teams: That 200-unit laptop refresh you’ve been planning? Every quarter you delay costs you 8-12% in trade-in value. With new devices appreciating and old ones depreciating, the gap is widening fast.

For Retail Partners: Consumer trade-in programs aren’t just good for sustainability—they’re economic leverage. Customers upgrading sooner capture more value, afford better devices, and stay in your ecosystem. The longer they wait, the more friction you create in the upgrade cycle.

For IT Procurement: Device lifecycle management isn’t about hardware alone—it’s about maintaining optionality. The organizations that proactively manage trade-ins and refreshes? They’re negotiating from positions of strength with vendors. The ones waiting until devices fail? They’re paying premium prices with zero negotiating leverage.

The Bottom Line

Here’s what the data says:

Device prices are rising. Device values are falling. The gap between them is your window of opportunity—and it’s closing.

Organizations that act now will:

- Capture 40-60% more trade-in value than those who wait 12-18 months

- Lock in current pricing before tariffs potentially add 25-45% to costs

- Reset their refresh cycles to proactive rather than reactive

- Convert depreciating assets into working capital

The certainty you’re looking for in uncertain times? It’s not in waiting—it’s in acting strategically before the market forces your hand.

At Phobio, we process 187,000+ device transactions annually across phones, laptops, wearables, and more. We work with our customers on this conundrum every day: organizations that plan ahead capture more value, experience less disruption, and sleep better at night. The ones that wait? They’re paying premium prices for emergency replacements while watching their trade-in equity evaporate.

Ready to turn your aging device inventory into working capital? Let’s talk about what your devices are actually worth—and what they won’t be if you wait.