A POV from the front lines of fitness technology and device lifecycle management

By Greg Kruchko, Chief Revenue Officer at Phobio

Personal Note: Why This Space Matters to Me

As a lifelong athlete who’s competed in everything from sprint triathlons to Ironman races, I live in the intersection of fitness and technology every single day. My training isn’t just about logging miles or hitting the gym – it’s about understanding the intricate dance between effort, recovery, and readiness that determines whether I’ll have a breakthrough race or struggle to the finish line.

My fitness devices aren’t just gadgets; they’re essential tools in my athletic journey. My heart rate monitor tells me when I’m pushing too hard or not hard enough during intervals. My bike computer tracks power output and helps me pace long rides strategically. My wearable monitors my sleep quality, HRV trends, and recovery metrics that directly influence my training decisions. When my device shows elevated resting heart rate or poor sleep scores, I know to adjust my training load or focus on recovery.

I’ve been through multiple generations of devices from different manufacturers, always chasing that perfect combination of accuracy, battery life, and insights that can give me an edge. Each upgrade has taught me something new about my physiology and performance. But it’s also left me with a drawer full of “old” devices that are still incredibly capable – a reality I know resonates with millions of other passionate athletes and fitness enthusiasts.

This personal experience with the upgrade cycle, combined with my professional perspective on device lifecycle management, gives me a unique lens on the massive opportunity in fitness technology trade-in programs. When I see the market dynamics playing out, I don’t just see business metrics – I see the real-world impact on athletes like myself who want to stay current with technology while making smart financial decisions.

Executive Summary

The fitness technology market is experiencing unprecedented growth, expanding from $60.9 billion in 2024 to a projected $323.47 billion by 2034. This isn’t just market expansion – it’s a fundamental shift in how people engage with their health and fitness data.

Key Market Dynamics:

- Premium devices ($200-$800+) purchased by passionate users who upgrade every 18-24 months

- Major brands (Garmin, WHOOP, Oura, Apple, Fitbit) releasing new products annually with meaningful improvements

- Diverse user segments with different upgrade motivations: data-driven athletes, wellness-focused users, and recovery-optimized trainers

- Growing challenge of valuable used devices sitting unused after upgrades

The Trade-In Opportunity: Device trade-in programs represent the missing infrastructure in the fit-tech ecosystem, solving critical challenges for both OEMs and consumers:

For OEMs: Reduced upgrade friction, improved customer retention, new customer acquisition tool, and sustainable competitive advantage

For Consumers: Better upgrade economics (transforming $400 purchases into $200-250 net investments), easier access to latest technology

For the Market: Sustainable device lifecycle management and extended product utility

Phobio’s Strategic Position: As the infrastructure partner enabling this ecosystem, Phobio offers:

- Seamless integration with OEM checkout flows

- Specialized expertise in fitness device assessment and refurbishment

- Scale logistics and reverse supply chain management

- Data insights that inform product development and marketing strategies

Bottom Line: Trade-in programs are evolving from nice-to-have features to essential competitive tools in fit-tech. The brands that embrace device lifecycle management first will capture sustainable advantages in customer acquisition, retention, and lifetime value.

Wellness is Having Its Moment – And It’s Massive

We’re living through a wellness revolution that’s reshaping entire industries, and fitness technology sits at the epicenter. The numbers tell an incredible story: the global fitness tracker market has exploded from $60.9 billion in 2024 to a projected $323.47 billion by 2034 – that’s an 18% compound annual growth rate that makes even the most optimistic tech forecasts look conservative.

But here’s what gets me excited: this isn’t just growth, it’s a fundamental shift in how people think about their health. We’ve moved from wellness being a nice-to-have to an essential part of daily life. The pandemic accelerated this trend, but what we’re seeing now is sustained, passionate engagement with personal health data that’s creating entirely new consumer behaviors.

The Market is Exploding – And Everyone Wants In

The participant landscape in fit-tech has never been more dynamic. We’ve got the established players like Garmin, who’ve built their reputation on precision and durability for serious athletes. There’s Fitbit (now Google), democratizing fitness tracking for the masses. WHOOP has carved out the recovery and optimization space with their subscription model. Oura revolutionized the form factor with smart rings. Wahoo dominates cycling with their ecosystem approach.

But here’s where it gets interesting – we’re seeing new entrants almost monthly. Traditional watch manufacturers, tech giants, even healthcare companies are jumping in. Why? Because the addressable market keeps expanding. We’re not just talking about fitness enthusiasts anymore; we’re seeing adoption across demographics that never would have considered a fitness tracker five years ago.

The wearables market shipped 534.6 million units in 2024, up 5.4% year-over-year, and that growth is accelerating in specific segments. What’s driving this isn’t just better technology – though that’s certainly part of it – it’s that we’ve finally cracked the code on making these devices indispensable rather than just interesting.

The Innovation Treadmill: When Product Cycles Accelerate Consumer Desire

Here’s something fascinating about the fit-tech space: product innovation cycles are getting shorter while consumer appetite for upgrades is growing stronger. We’re seeing major releases from key players every 12-18 months, with iterative updates hitting the market even more frequently.

Take Apple’s approach – they’ve moved to an annual refresh cycle for the Apple Watch, with each generation bringing meaningful improvements in sensors, battery life, or form factor. Garmin releases multiple product lines annually across different use cases. WHOOP just launched their 4.0 after their 3.0, with significant hardware improvements. Oura moved from Generation 2 to 3 with game-changing features.

But here’s the kicker: unlike smartphones where upgrade cycles have stretched to 3-4 years, fitness enthusiasts are upgrading their devices every 18-24 months. Why? Because these aren’t just gadgets – they’re tools that directly impact performance, health insights, and training outcomes. When a new device promises better sleep tracking, more accurate heart rate variability, or longer battery life, passionate users see immediate, tangible value.

Premium Devices, Passionate Users, Diverse Use Cases

This isn’t the race-to-the-bottom commodity market that some predicted. We’re talking about premium devices – $200-$800+ – purchased by incredibly engaged users who see them as essential tools rather than optional accessories.

The user base breaks down into fascinating segments. You’ve got the data-driven athletes who live and breathe metrics – they want the most accurate sensors and the deepest analytics. There are the wellness-focused users who care more about trends and motivation than precision. Recovery-focused users want sleep optimization and stress management. Outdoor enthusiasts need ruggedness and GPS accuracy.

Each segment has different upgrade triggers and different willingness to pay for incremental improvements. The endurance athlete will upgrade for a 2% improvement in GPS accuracy. The wellness user might upgrade for better sleep insights or a more comfortable form factor. This diversity creates multiple upgrade cycles happening simultaneously across the user base.

The Growing Challenge: What Happens to Yesterday’s Innovation?

Here’s where the market dynamics get really interesting – and where opportunity emerges. As technology improves and new participants keep entering the market, we’re creating a massive volume of “displaced” devices. These aren’t broken phones that need replacement; these are often perfectly functional, premium devices that are being replaced because something better came along.

Think about it: a Garmin Forerunner 945 from two years ago is still an incredible piece of technology that could serve most users’ needs perfectly. But its owner just upgraded to the latest model for improved battery life and new training metrics. That “old” device represents hundreds of dollars of value that’s now sitting in a drawer.

Multiply this across millions of passionate users upgrading regularly, and you’ve got a secondary market opportunity that’s massive and largely untapped. But here’s the challenge most OEMs face: they’re brilliant at innovation and manufacturing, but they don’t have the infrastructure, expertise, or bandwidth to manage device trade-ins and refurbishment at scale.

Enter Trade-In: The Missing Link in the Fit-Tech Ecosystem

This is where the magic happens – and where Phobio enters the picture. Device trade-in isn’t just about extracting residual value; it’s about creating a sustainable ecosystem that benefits everyone involved.

For OEMs, trade-in programs solve multiple challenges simultaneously. First, they reduce the friction for consumers to upgrade by offsetting the cost of new devices. We’ve seen this work brilliantly in smartphones – trade-in programs consistently drive higher upgrade rates and shorter replacement cycles. In fitness tech, where devices are premium-priced and users are upgrade-motivated, the impact can be even more pronounced.

Second, trade-in programs help OEMs capture consumers who might otherwise go to competitors. When someone’s thinking about switching from Garmin to WHOOP or from Fitbit to Oura, a generous trade-in offer can be the difference between retention and churn. It’s customer acquisition and retention rolled into one.

For consumers, trade-in transforms the economics of staying current with technology. Instead of a $400 upgrade being a pure cost, it becomes a $200-250 net investment when they can trade in their existing device. This makes the upgrade decision much easier and keeps them engaged with the ecosystem.

But here’s what makes this really powerful: trade-in programs create a flywheel effect. Better upgrade economics lead to more frequent upgrades, which creates more trade-in inventory, which enables better trade-in values, which drives more upgrades. It’s a virtuous cycle that benefits everyone.

Phobio’s Unique Position: The Infrastructure Behind Innovation

What excites me about Phobio’s opportunity in this space is that we’re not just another trade-in company – we’re the infrastructure that enables this entire ecosystem to function. We handle the complex logistics of device assessment, refurbishment, and remarketing that OEMs can’t do efficiently on their own.

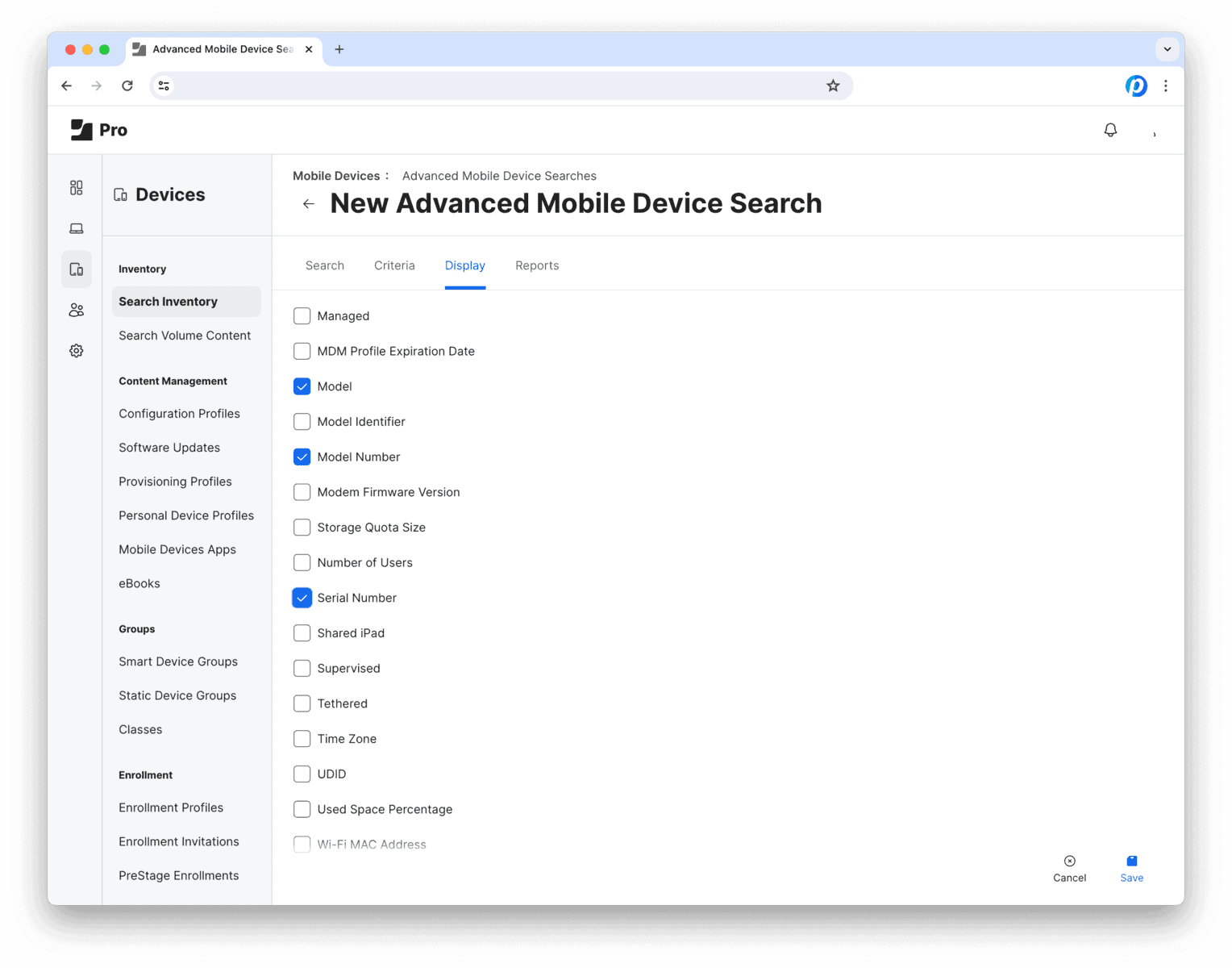

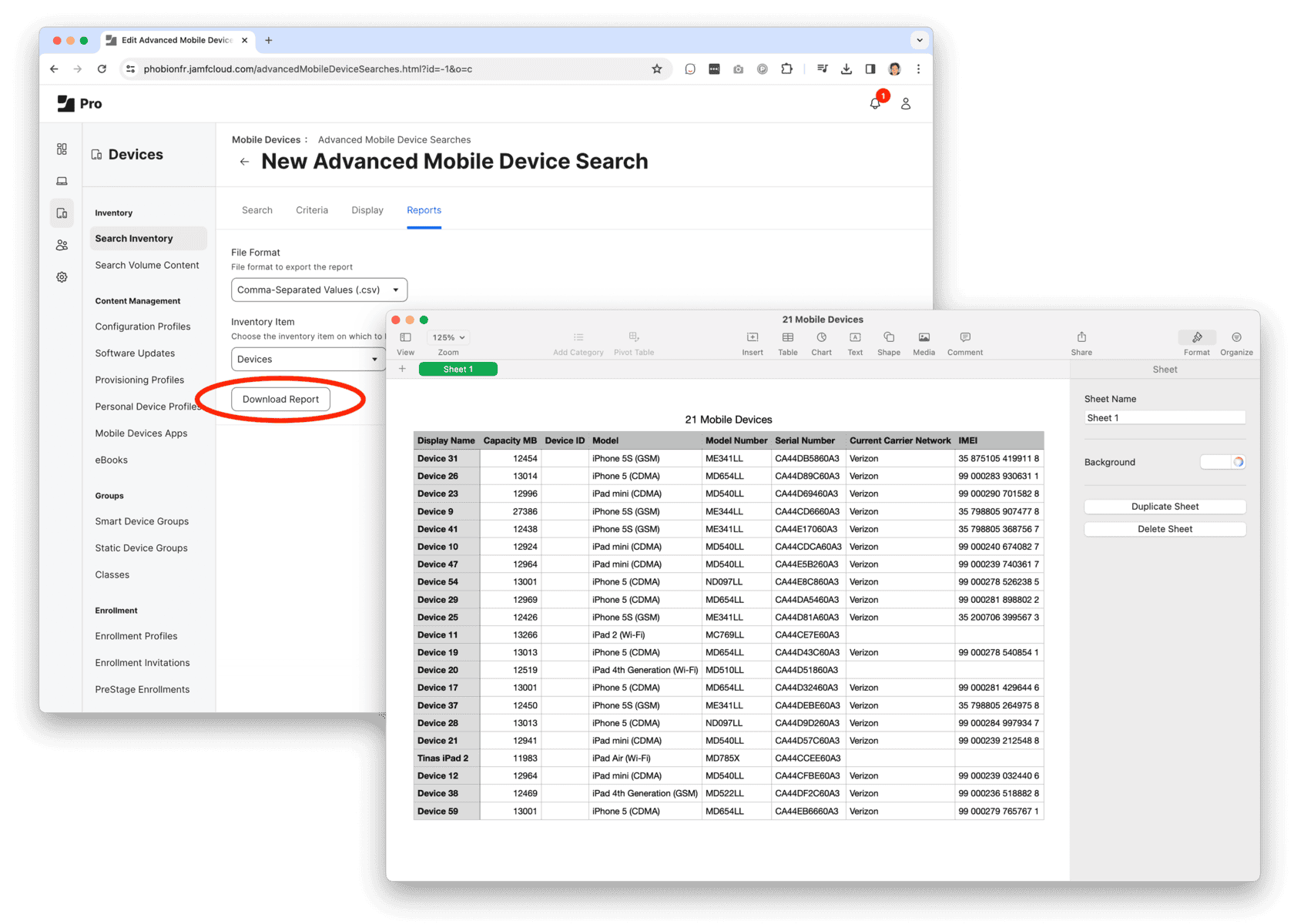

Our technology platform can integrate seamlessly with OEM checkout flows, making trade-in as simple as entering a device serial number. Our logistics network can handle the reverse supply chain at scale. Our refurbishment capabilities can turn traded-in devices into certified pre-owned inventory that creates new customer segments for OEMs.

Most importantly, we understand that in fitness tech, condition assessment isn’t just about scratches and battery life. These devices have been worn during workouts, exposed to sweat, used in various environmental conditions. Our assessment criteria account for the unique wear patterns of fitness devices, ensuring accurate valuations that maintain consumer trust.

The Strategic Opportunity: Building the Future of Fit-Tech Commerce

Looking forward, I see trade-in becoming table stakes for serious players in the fit-tech space. The brands that figure this out first will have a sustainable competitive advantage in customer acquisition, retention, and lifetime value.

For OEMs, partnering with Phobio isn’t just about adding a trade-in program – it’s about accessing expertise in device lifecycle management that would take years and millions of dollars to build internally. We become an extension of their team, handling the complex operational challenges while they focus on what they do best: innovation.

The data insights we generate also become incredibly valuable. Understanding trade-in patterns, device lifespans, and upgrade motivations gives OEMs critical intelligence for product development and marketing strategies. When we see trade-in volume spike for specific models, it tells us something about consumer preferences that can inform future product decisions.

Conclusion: The Ecosystem Play

The fit-tech space is evolving from a collection of individual product categories into an integrated ecosystem where hardware, software, services, and commerce all interconnect. Trade-in programs are becoming a critical component of this ecosystem – not just as a value-add feature, but as a fundamental enabler of sustainable growth.

At Phobio, we’re not just facilitating device exchanges; we’re helping build the infrastructure that will power the next decade of fitness technology innovation. We’re making it easier for consumers to access the latest technology, easier for OEMs to acquire and retain customers, and more sustainable for the entire industry by extending device lifecycles.

The wellness revolution is just getting started, and the brands that understand the full lifecycle of their devices – from initial purchase through multiple ownership cycles – will be the ones that thrive. That’s where Phobio comes in, and that’s why I’m incredibly excited about our opportunity in this space.

The question isn’t whether trade-in will become essential in fit-tech. The question is which brands will embrace it first and gain the competitive advantage that comes with making their customers’ upgrade decisions easy, affordable, and sustainable.