An insider’s look at the tactics shaping your hardware disposition deals

The bottom line: If you’re accepting 60/40 revenue splits on your retired IT assets, you’re likely leaving significant money on the table. The ITAD industry has perfected psychological tactics that artificially deflate asset values and maximize their margins at your expense:

The Scarcity Theater

Picture this scenario: You contact an ITAD provider about disposing of your company’s retired laptops. Within minutes, they’re explaining how the market is “flooded” with exactly your model, how timing is terrible, and how everyone else is dumping similar equipment right now. Sound familiar?

This isn’t market analysis—it’s manufactured scarcity theater. The primary tactic involves convincing sellers that their assets exist in an oversaturated market, regardless of actual demand conditions. Whether it’s summer (“everyone’s refreshing their hardware”) or any other season, there’s always a convenient explanation for why your equipment is worth less than you think.

The “Vast Resources” Mirage

ITAD buyers love to project infinite purchasing power during initial conversations. They’ll claim to buy “everything” in “huge lots” with “eleventy billion dollars” of liquidity. This psychological positioning makes sellers feel they’ve found a serious buyer with deep pockets.

The reality check comes later: suddenly that buyer can only handle a fraction of your inventory, but still demands the same ultra-low pricing they promised for bulk purchases. It’s a classic bait-and-switch that exploits the seller’s time investment and desire to close a deal.

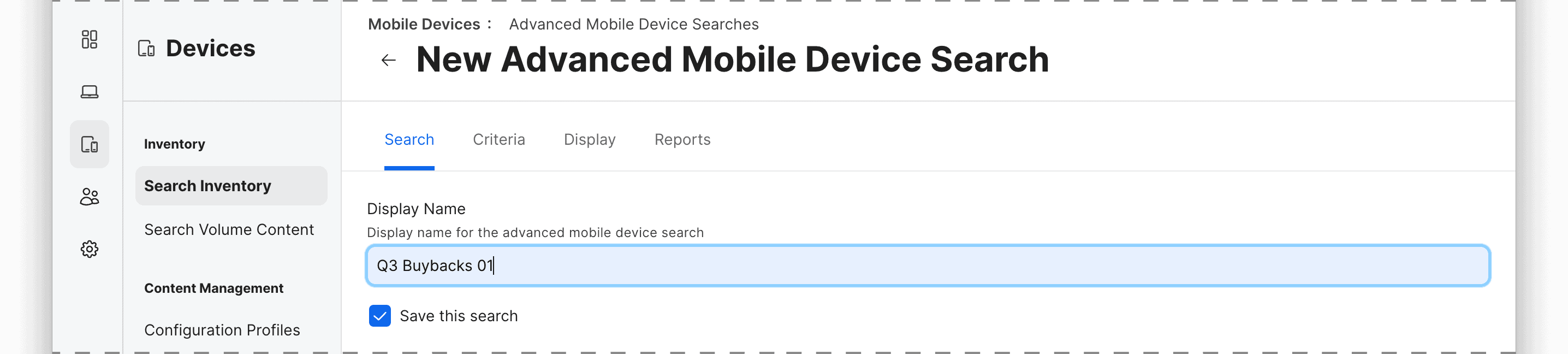

The Low-Bar Recovery Game

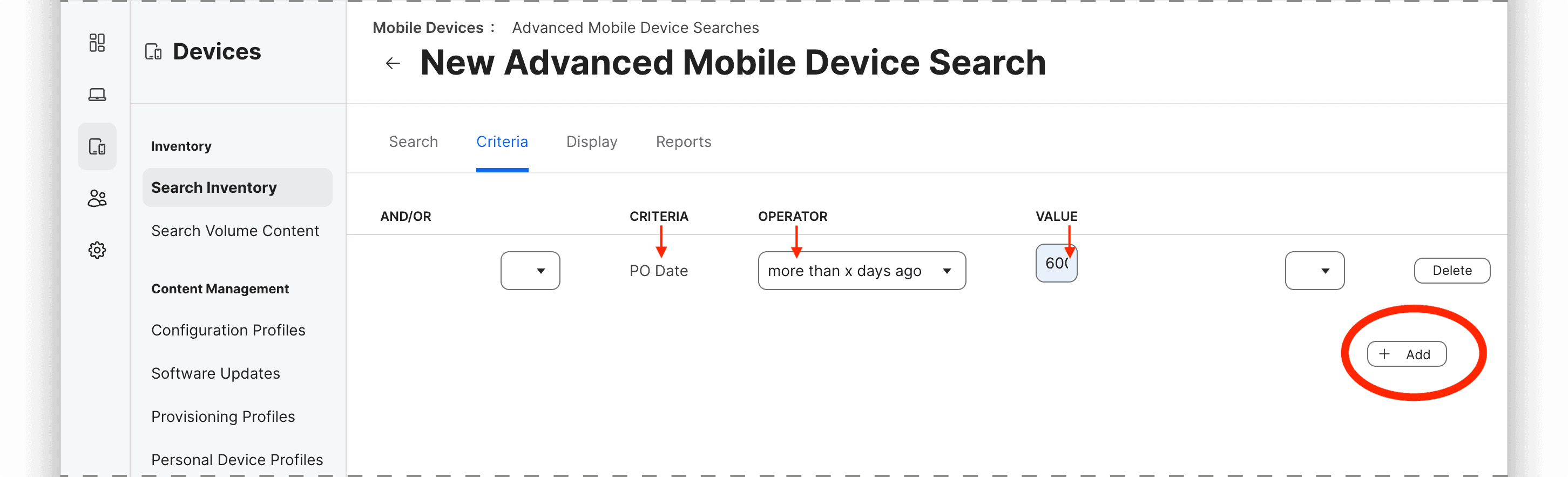

Traditional ITAD providers have mastered the art of expectation management through deliberately low initial estimates. Here’s how it works:

They take your 1,000 computers, process them at roughly $20-25 per unit (testing, grading, data wiping), then sell the recovered assets. After deducting their processing costs, they split the remaining revenue—typically 60% to you, 40% to them. While this might seem reasonable, the model incentivizes them to minimize asset values and maximize processing fees.

The psychological brilliance lies in positioning any recovery as better than “worthless equipment sitting in your closet.” By convincing you that disposal is your only alternative, they transform any positive return into a perceived victory.

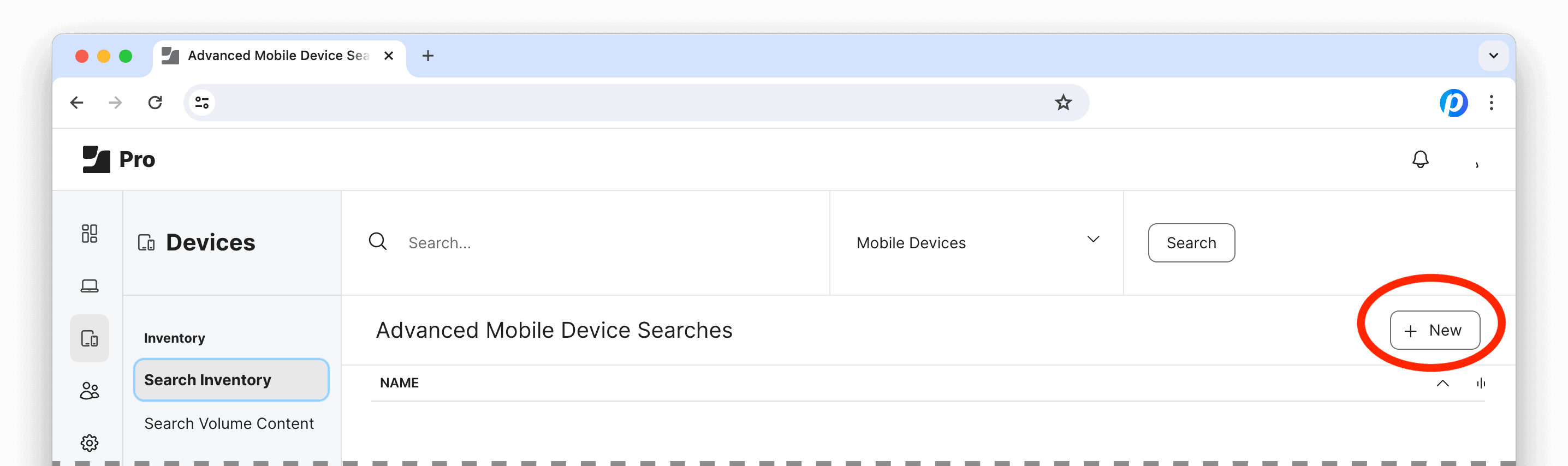

Breaking the Integrity Test

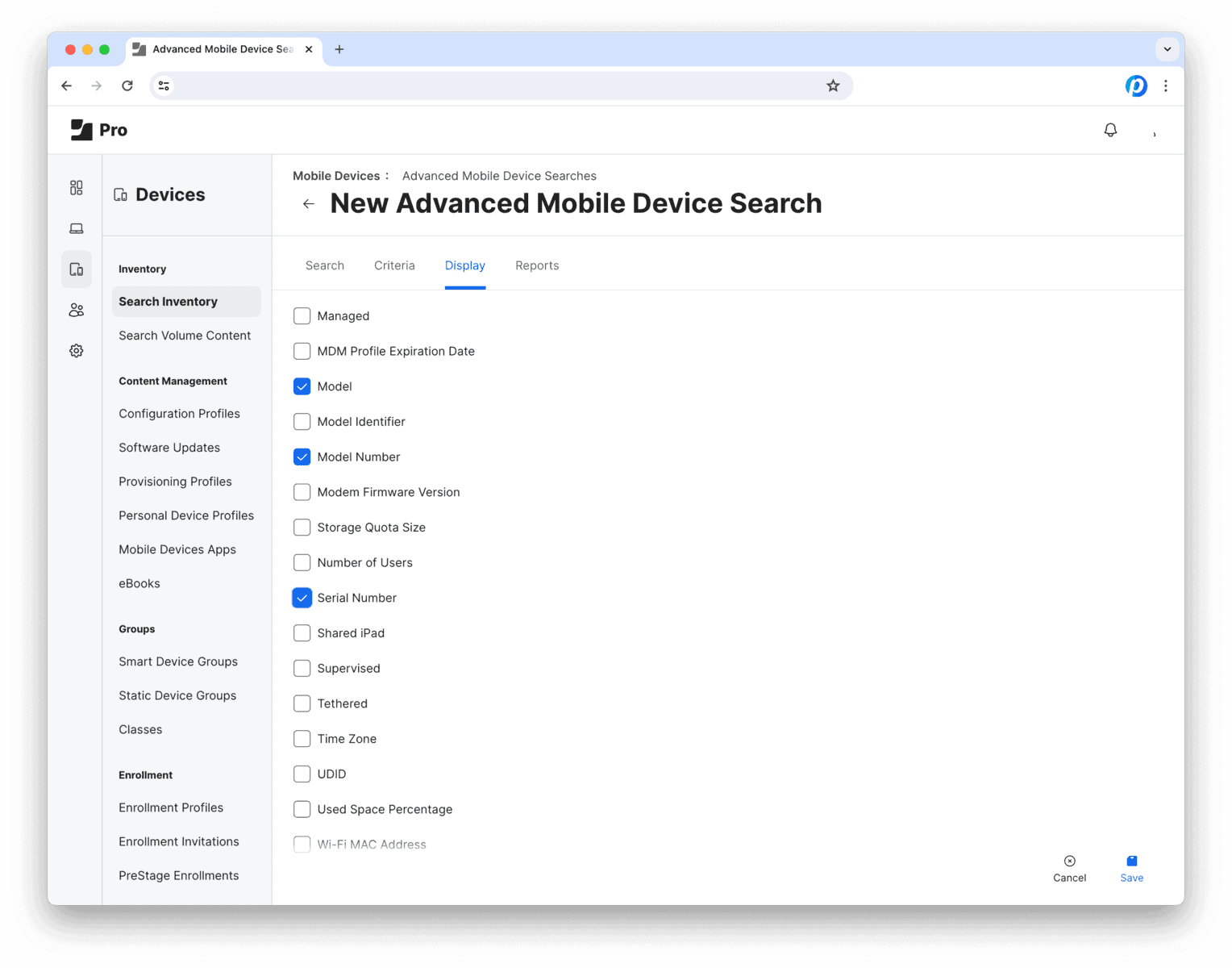

When evaluating ITAD proposals, apply this three-point integrity test:

- Market Access: Do they have genuine downstream channels, or are they simply middlemen adding layers? A provider claiming they “can’t give pricing” likely lacks robust resale networks.

- Sales Methodology: Are they using old-school pressure tactics or transparent, systematic approaches? Legitimate providers should easily explain their pricing methodology.

- Honesty Factor: Simply put, are they being straight with you about market conditions and asset values?

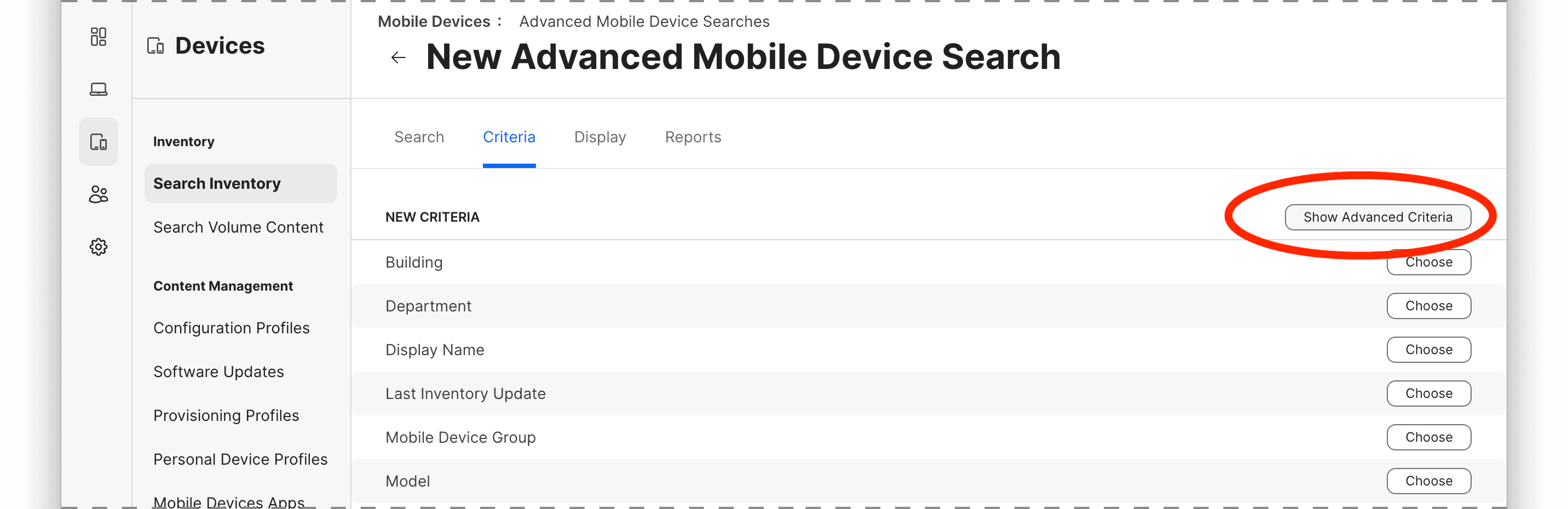

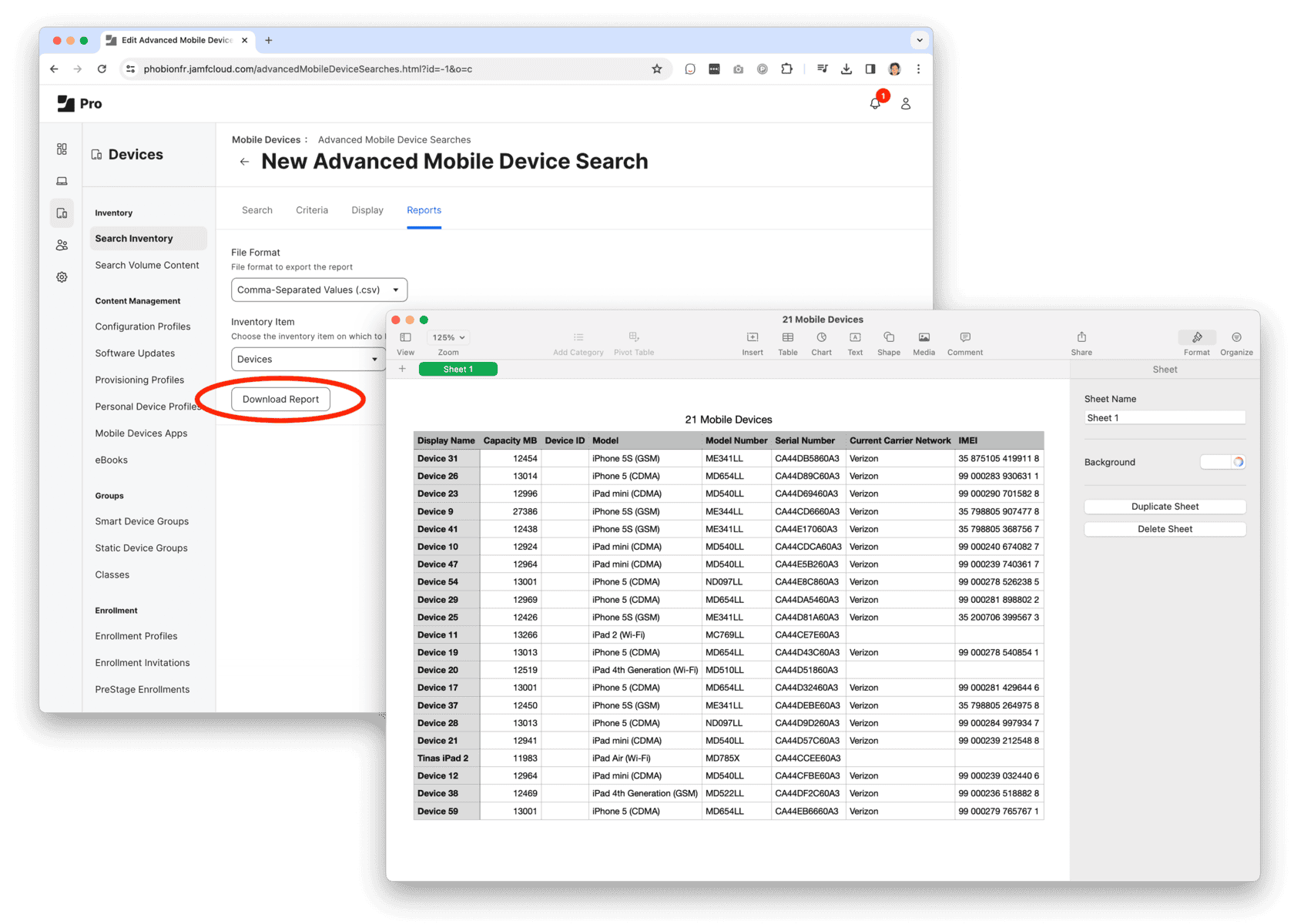

The Disruption Opportunity

The industry’s standard 60/40 split (after costs) represents an opportunity for disruption. Some providers are now offering 80/20 splits, fundamentally challenging the traditional model. This shift forces a critical question: if someone can profitably operate at 80/20, what does that say about the necessity of 60/40 arrangements?

For IT managers, this represents leverage. When existing providers can’t match improved terms, it exposes either their inflated cost structures or their reluctance to reduce historically high margins.

Time-Sensitive Realities

Here’s an uncomfortable truth the ITAD industry won’t emphasize: technology asset values depreciate rapidly. Equipment sitting in storage doesn’t just lose value—it becomes a drain on the overall lot value. The longer you wait, the more your viable assets subsidize the worthless ones.

Smart IT managers are moving toward immediate disposition upon equipment retirement, capturing maximum recovery before depreciation accelerates.

The Path Forward

The ITAD industry has conditioned IT managers to accept suboptimal outcomes by controlling the narrative around asset values and market conditions. Understanding these tactics is the first step toward securing better terms.

Action items for IT managers:

- Demand transparent pricing before committing to any ITAD relationship

- Question any provider who claims they “can’t provide quotes” due to market uncertainty

- Compare multiple approaches: traditional ITAD services versus direct wholesale buyers

- Calculate the true per-unit recovery after all fees and splits

The goal isn’t to eliminate ITAD providers—many offer legitimate value through secure data destruction and compliance services. The goal is to ensure you’re not subsidizing inflated margins through artificially suppressed asset valuations.

Remember: Your retired equipment has real value. Don’t let outdated industry practices convince you otherwise.