As Chief Revenue Officer at Phobio, I work with hundreds of SMBs annually who are transforming their approach to technology investment. The most successful ones aren’t just buying devices—they’re building sustainable refresh strategies that maximize ROI while maintaining cutting-edge capabilities. Here’s what the data reveals about the strategic advantage of trade-in programs.

The Modern SMB Technology Challenge

Today’s SMBs face a fundamental challenge: they need cutting-edge technology to compete, but must be strategic about every dollar spent. SMBs are most likely to cite investing in new technology to automate and improve operations as their top strategic initiative for 2024, with 64% of SMBs indicating technology is a primary factor in pursuing their business objectives, rising to 73% for medium companies with 99-249 employees.

The investment requirements are substantial:

- Global SMB IT spending reached $243.32 billion in 2024, expected to grow to $361.29 billion by 2033 at a 4.49% CAGR

- Gartner predicts 9.8% growth in SMB IT spending for 2025

- Analysys Mason forecasts SMB IT spending growth rising from 6% in 2024 to 8% by 2028

Meanwhile, cash flow remains a key consideration. 70% of SMBs hold less than four months’ worth of cash reserves, with more than 90% of their revenue consumed by operational costs. This creates pressure to optimize every technology investment for maximum value.

Core Device Priorities: Laptops and Mobile

SMBs depend on two critical device categories that directly impact productivity:

Mobile Devices: Business workers rely on best-in-class video and audio features for frequent conference calls, requiring minimum FHD cameras, top-firing speakers, and Wi-Fi 6E and 5G connectivity. With hybrid work permanent, mobile devices are essential business tools.

Laptops: Workers need mobile and flexible form factors for working on-the-go, with business laptops ideally being lightweight and small while including 16:10 aspect ratio displays for optimal front-of-screen experience. The challenge? Studies consistently show the optimal refresh cycle for laptops and desktop computers is 3 years, with maintenance and support costs for PCs older than 3 years higher than purchasing new systems.

Who Makes These Decisions?

The buying process has evolved significantly. An overwhelming majority of SMBs have moved away from a federated model to centralize purchasing decisions. Among businesses with more than 25 FTEs, 37% say that the IT department is expected to hold more power in decision making during the next 12 months.

Key decision makers include:

- IT Directors who must balance technology needs with budget constraints and demonstrate ROI

- CFOs who are focused on evaluating fit via blogs, case studies, demos, reviews, whitepapers and payback through ROI tools

- CEOs who need strategic technology investments that drive competitive advantage without overextending resources

The Trade-In Market Opportunity

The device trade-in market has created unprecedented opportunities for strategic SMBs:

Market Growth

- U.S. businesses and consumers received $4.5 billion through trade-in programs in 2024, reflecting a 5% increase over 2023

- Q1 2025 alone returned $1.24 billion to consumers—a 40% increase over Q1 2024

- The global used smartphone market was valued at $46.52 billion in 2024 and is expected to reach $189.86 billion by 2034, growing at a CAGR of 15.10%

Perfect Timing Alignment

The iPhone 13 emerged as the most turned-in device for three consecutive quarters, while the Samsung Galaxy S22 Ultra 5G was the most traded-in Android device. The average age of iPhones at turn-in is 3.69 years, while Android devices average 3.38 years—perfectly aligned with optimal business refresh cycles.

Strategic Benefits for SMBs

1. Cash Flow Optimization

Instead of large capital expenditures every 5-7 years, trade-in programs enable:

- Predictable annual refresh budgets

- Immediate cash recovery from existing devices

- Reduced total cost of ownership by 25-40%

2. Productivity ROI

J. Gold Associates found that companies on a 2-year upgrade cycle experience productivity improvements ranging from 4.49% to 11.57%, yielding average annual savings between $5,077 and $13,103 per employee.

The impact is real: Two out of three employees say that outdated technology has the most significant impact on their productivity. Over 60% of employees using work-issued computers say that the devices have prevented them from getting work done, while 70% say they’d enjoy their job more if they had better equipment.

3. Competitive Positioning

A majority of SMBs are willing to pay extra for AI capabilities embedded in the solutions they already use, with a sweet spot of 10% to 20% for these additional capabilities. Trade-in programs make these premium investments more accessible by reducing net cost through value recovery.

Financial Impact: Real Numbers

Consider a 75-employee professional services firm:

Traditional 5-Year Hold Strategy:

- 75 laptops at $1,400 each = $105,000

- 75 mobile devices at $800 each = $60,000

- Total investment: $165,000

- 5-year hold, zero residual value

- Productivity loss years 4-5: ~$180,000 (based on employee inefficiency)

Strategic 3-Year Trade-In Approach:

- Same initial investment: $165,000

- Year 3 trade-in value: ~$41,250 (25% average residual)

- Net replacement cost: $123,750

- Productivity gains maintained throughout cycle

- Net advantage: $221,250 over 6-year period

Market Trends Supporting Trade-In Strategy

SMBs increasingly prefer to have direct relationships with technology suppliers rather than go through third-party sellers. That’s particularly true for SMBs with fewer than 100 FTEs, which have simpler technology requirements and are about twice as likely to go directly to providers.

This creates opportunities for SMBs to negotiate integrated trade-in programs directly with OEMs and service providers, maximizing both purchase and residual values.

The organized second-hand smartphone market is expected to achieve a 44% increase from 2024 to 2028, representing growth from $32 billion to $46 billion. This expanding market creates sustained opportunities for SMBs to monetize their technology investments.

What SMBs Should Do Now

The data shows clear advantages for SMBs that implement strategic trade-in programs:

Financial Benefits:

- 25-40% reduction in net technology investment

- Predictable refresh budgeting with guaranteed residual values

- Improved cash flow management

Operational Advantages:

- Up to 11.57% productivity improvement per employee through consistent refresh cycles

- Enhanced employee satisfaction and retention

- Maintained competitive technology positioning

Immediate Action Items:

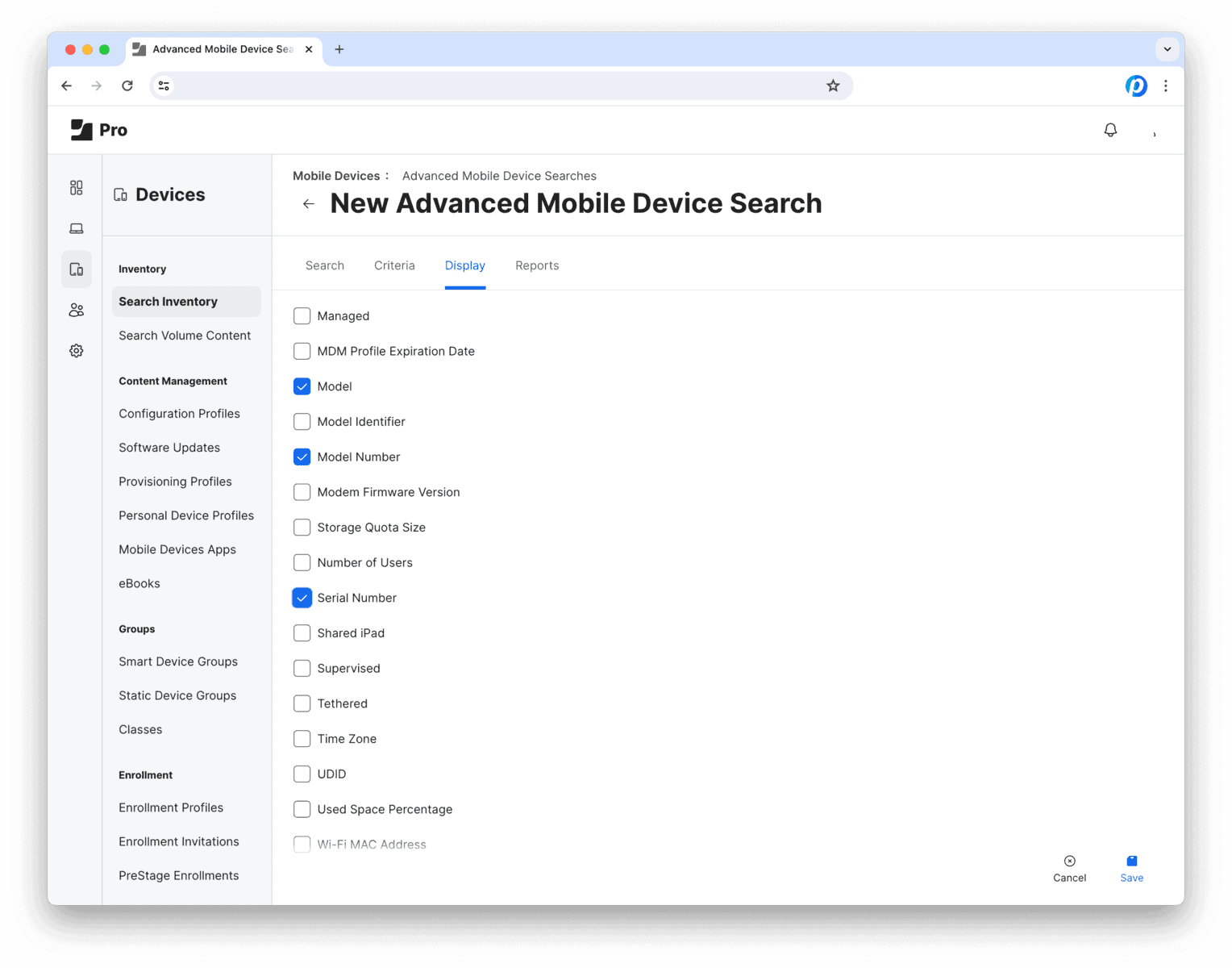

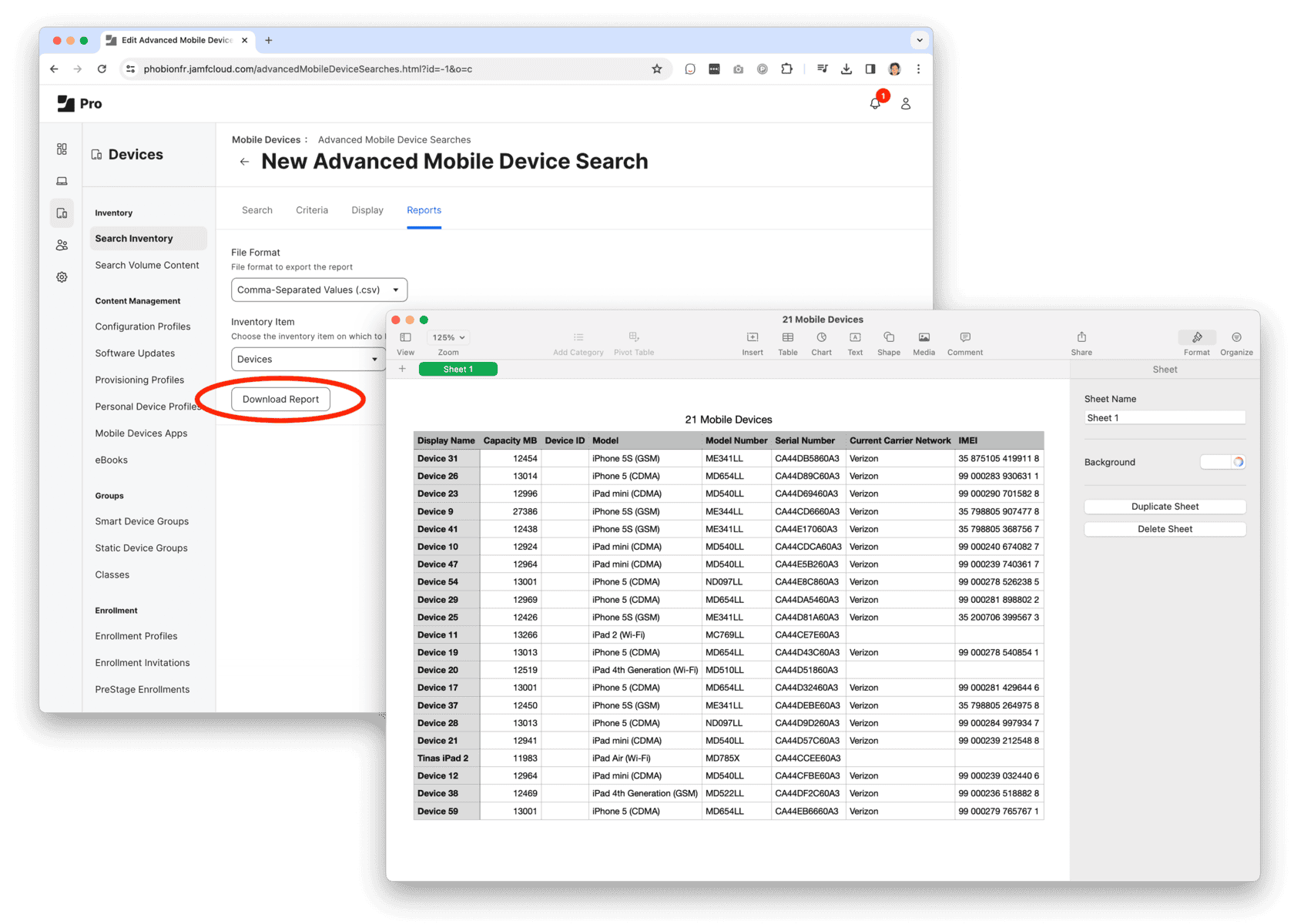

- Audit Current Devices: Inventory your laptops and mobile devices, noting age and condition

- Calculate Trade-In Values: Get quotes on current device values to understand immediate cash recovery potential

- Model 3-Year Refresh Cycles: Compare total cost of ownership between traditional hold strategies and trade-in approaches

- Partner with Trade-In Specialists: Work with experienced trade-in partners like Phobio to integrate device lifecycle management into your refresh strategy, maximizing residual values and streamlining the entire process

- Plan Refresh Timing: Align device refreshes with budget cycles and business growth plans

The SMB technology landscape isn’t just about spending more—it’s about spending smarter. Trade-in programs represent the evolution from ad-hoc technology purchasing to strategic asset lifecycle management.

Ready to transform your technology investment strategy? The trade-in opportunity has never been stronger, and the SMBs implementing these programs today are building sustainable competitive advantages for tomorrow.