The consumer electronics industry is already feeling the effects of an economic downturn. Sales are down, consumers are shying away from expensive purchases, and prices are rising – which further puts consumers off.

Electronics manufacturers are feeling the effects of inflation, rising mineral prices, and a turbulent supply chain.

It doesn’t look good. Yet, device trade-in helps to address these challenges.

Device trade-ins can slash material costs of manufacturing, bolster the domestic supply chain, and increase consumer spending power putting money directly back in their wallets.

The Consumer Electronics Market is Cooling

The pandemic electronic market boost is over. Consumers are spending far less on electronics than they used to. The current smartphone replacement cycle is the longest it’s ever been, at over 43 months. They are purchasing less frequently and opting for cheaper, lower-end products.

Unit shipments in the North American smartphone market were down 6% in the second quarter of 2022, with only four companies showing sales growth.

- Apple: 3% annual growth with 52% of market share and 18.5 million units shipped

- Samsung: 4% annual growth with 26% of market share and 9 million units shipped

- Motorola: 1% annual growth with 9% of market share and 3.1 million units shipped

- Google: 230% annual growth with 1% of market share and 0.8 million units shipped

The market winners reported startling low growth rates. And Google’s massive 230% growth is mitigated by its much smaller percentage of the market share.

Sales growth was concentrated in the less expensive products, with a smaller group of buyers sustaining the high-end device market. Consumers who were formerly in the mid-range market are feeling the financial crunch more.

Canalys Research Analyst Brian Lynch says, “decreasing purchasing power is forcing buyers who normally would consider devices costing between US$250 and US$600 to look for cheaper options as consumers continue to feel the financial pressure of inflation on everyday expenses.”

His colleague Runar Bjørhovde says, “economic headwinds, sluggish demand and inventory pileup have resulted in vendors rapidly reassessing their portfolio strategies for the rest of 2022. The oversupplied mid-range is an exposed segment for vendors to focus on adjusting new launches, as budget-constrained consumers shift their device purchases toward the lower end.”

These problems aren’t isolated to the United States. Worldwide smartphone shipments were down 9% year-on-year, falling to the lowest quarterly figure since Q2 of 2020 when the pandemic’s effects first hit.

Worldwide wearable band shipments were down 4% in 2022’s Q1. And worldwide PC shipments were down 15% in Q2 2022, experiencing a sharp drop after China’s Zero Covid policies resulted in extensive lockdowns across key manufacturing and export areas.

The IPC’s June of 2022 Global Sentiment of the Electronics Supply Chain Report details a bleak electronics manufacturer outlook.

- 9 in 10 were currently experiencing rising material costs

- 0% of North American manufacturers expected material costs to decline

- 86% of North American manufacturers experienced rising labor costs

- 78% were worried about a 2023 recession

- 86% were concerned about inflation

- 8 in 10 were concerned about a prolonged Russia-Ukraine war causing extended supply chain disruptions

- Only 7% of North American manufacturers reported rising profit margins

The IPC narrowed their concerns down to three factors: geopolitical uncertainties, inflationary pressures, and exacerbated supply chain problems due to China’s ongoing Covid lockdowns.

But the entire consumer electronics industry is struggling to cope with the compounding effects of supply chain challenges, inflation, the Russia-Ukraine conflict, rising material prices, and decreased consumer spending.

Lowered consumer spending is a worrying concern, as it means consumers can’t absorb the higher prices.

The First Challenge: Lowered Consumer Spending

Why aren’t consumers buying? You can put that down to consumers having less discretionary spending money and being generally unmoved by new products.

Inflation is high and still surging. June’s core inflation was up 5.9% year-over-year and the consumer price index rose by 9.1% year-over-year – the fastest increase since 1981.

Unemployment might be low, but inflation is eating away at purchasing power. The Bureau of Economic Analysis shows a 6.8% rise in the Personal Consumption Expenditures (PCE) price index from July of 2021 to July 2022. And the Bureau of Labor Statistics (BLS) reports an 8.5% year-over-year increase in the Consumer Price Index for all Urban Consumers in the same timeframe.

Meanwhile, economic data from the St. Louis Federal Reserve’s FRED shows a 3.75% decrease in real disposable personal income from July 2021 to July 2022. And the BLS reports that real average weekly earnings decreased by 3.6 % during the same timeframe.

A Spending Drawback

Deloitte’s State of the US Consumer study found 79% of respondents concerned about prices going up. The overall response to this concern has been a widespread consumer pullback on spending.

Analysis of consumer spending intent finds a steady withdrawal from discretionary spending, with US consumers allocating less towards splurges.

A banking survey of 600 adults found that 10.5% had completely eliminated all non-essential purchases. Younger and lower-income Americans are cutting back on splurges and spending more of their income on basics like gas and bills, with some choosing to entirely skip some of the basics.

Think they’ll dip into their savings for a new laptop or phone upgrade? That’s not likely, since consumers have tapped out their pandemic savings.

Depleted American Savings

Americans built up a healthy stockpile of cash thanks to pandemic relief programs and lowered early pandemic spending. That’s gone now – especially for lower-income Americans – and everyone is reining in the spending.

The national Personal Savings Rate has plummeted to 5%, down from a record 33.8% in April of 2020. And Americans are reacting with concern. In May 2021, when savings were at 10.4%, Deloitte found that only 33% of Americans were worried about their savings. As of August 2022, 61% of Americans are.

Overall consumer confidence is down to 58.2% from 70.3% last year. As consumer sentiment dwindles, there’s little on the horizon to assuage their concerns.

Here’s the thing, inflation is just beginning to catch up. As bad as things might have been, the strain is only just starting to show.

Furthermore, consumers were already expressing reluctance to upgrade and holding onto existing devices for longer.

Currently Satisfied and Generally Unimpressed

Many consumers don’t really see the point in upgrading devices or swapping out their tech for something fresh. This trend has been developing for a few years. The smartphone lifecycle has been steadily increasing since 2016.

This can be put down to high prices and diminishing technological advances. At some point, the average user isn’t going to experience that many benefits from switching to a newer model. And certainly not enough to justify the expense.

Innovation is still declining while prices remain high. Most consumers just don’t think it’s worth it. 5G is the only development on the market that consumers express willingness to upgrade for. But even those consumers are hanging onto older devices. 5G alone may not be enough to compensate for the expense.

Some analysts think the smartphone innovation age is over. That’s yet to be seen, but for now, we’re certainly past the point of manufacturers being able to roll out flashy new updates and see high sales.

This market is already saturated.

- 97% of Americans own a cellphone

- 77% own a desktop or laptop

- 53% own a tablet computer

And they see little reason to upgrade. Today’s mobile users are content and expressing high consumer satisfaction levels with their providers, plans, and devices.

A recent Deloitte survey found that 40% of respondents didn’t consider upgrading their phones to be a priority and planned to keep their existing devices for at least 1.5 more years.

One thing that does push them to upgrade is planned obsolescence and difficulties getting repairs done. A trend that sees Americans wasting $40 billion per year.

When Americans do upgrade, they now choose between affordable low-end models or high-quality flagship devices that they can keep for extensive times.

The Analysts’ Assessment

Analysts have noted that American consumers are filtering out into two groups:

- lower-income consumers purchasing more affordable, low-end devices within their budget

- higher-income consumers purchasing flagship devices with an eye for higher quality, value, and longer lifecycles

This is what’s driving the current electronics market. And the trends are expected to continue.

Research firm Canalys noted this as recently as August 2022. August’s sales data showed Samsung’s growth concentrated in its low-end A series devices, along with its flagship Galaxy. Apple’s sales came from its iPhone SE, along with its iPhone 13.

The same trend is seen in the PC market. Canalys Senior Analyst Ishan Dutt says, “worsening inflation is the dominant economic factor on consumers’ minds, and price increases across a basket of goods and services are relegating spending on PCs and other hardware behind more basic needs.”

Dutt continues, “while the importance of having a top-quality device hasn’t diminished, most PC owners with relatively basic computing needs will be content to ride out this period of economic uncertainty and opt to refresh their devices when the pressure on their budgets eases or if significant discounting by vendors and retailers occurs later in the year.”

These factors are also seen in the Chromebook and tablet market, which has been particularly hard-hit since there are fewer business customers in this segment to compensate for decreased consumer spending.

Canalys Analyst Himani Mukka says, “inflation and fears of a recession are at the forefront of consumers’ minds, and spending on tablets has taken a backseat as the need for pandemic-era levels of use has fallen. Unlike notebooks, tablets are not vital for business productivity, so commercial demand has not helped to offset the drop in consumer purchases.”

It all comes down to the bottom line. The driving factor comes down to how much disposable income consumers have in their pockets – which isn’t much.

Consumers who can’t afford gas and have to cut down on food in order to heat or cool their homes, aren’t going to shell out more on gadgets.

If the consumer electronics market wants to boost spending, it’s going to have to do by alleviating consumers’ economic pressure and financially incentivizing them to upgrade.

The Second Challenge: High Material Costs and an Embattled Supply Chain

On the manufacturing side, the core challenges are rising material costs and ongoing supply chain issues – both of which result in higher prices for consumers.

The electronics parts supply chain is expected to see continued challenges into 2023. Supplyframe, an electronics industry analyst firm, predicts that needed commodities will continue to be in low supply and at a high cost.

Its AI platform predicts that 85% of pricing dimensions will increase and 83% of lead time dimensions will extend throughout the quarter.

It looks like everything is in short supply: resin feedstocks, additives, fuels, metals, components, and of course chips.

Shanghai’s zero-Covid lockdowns are crippling its supply chain, leading to rising costs and stymied exports. And there’s a fairly new federal law to watch out for – the Uyghur Forced Labor Prevention Act. This law restricts imports from China’s Xinjiang region. It’s estimated that 10% of the world’s manufacturing companies have a supply chain that touches this area.

Plus, the U.S. Commerce Department has been levying trade restrictions against an assortment of Chinese manufacturing companies in Guangzhou – the heart of its electronics manufacturing sector.

US firms are moving to manufacture chips domestically, but the shortage is still in effect. It takes time for these operations to begin producing and they still have to contend with raw material shortages.

Spiking Mineral Prices

Mineral prices keep rising and rising. China is the world’s main manufacturing and refining center, and it’s been pushing prices higher over the past several years. For example, the minerals used to make magnets for speakers have more than doubled in price. A mineral used in sensors has risen by almost 50%.

And this was before the Russia-Ukraine conflict. Russia is a mineral powerhouse and the main exporter of several minerals. It exported 37% of the world’s palladium – a mineral used in consumer electronics.

If costs aren’t brought under control, critical mineral prices will continue to be the driving factor in electronic prices.

But this is ultimately about way more than Covid, geopolitical conflicts, or administration-dependent policies. We’re at the point where running out of raw materials and relying on foreign components and minerals represents a national security threat.

Threats and Vulnerabilities

On December 20, 2017, the Trump Administration issued Executive Order 13817, “A Federal Strategy To Ensure Secure and Reliable Supplies of Critical Minerals.”

This order noted the US’ reliance on importing critical mineral commodities as a strategic vulnerability and threat to its security and economic prosperity. The past few years have proven this correct.

The order’s guiding recommendation of, “an increase in private-sector domestic exploration, production, recycling, and reprocessing of critical minerals,” needs to be taken seriously.

However, the US still imported 80% of its rare earth minerals from China in 2019. And in 2022, the Biden-Harris Administration found a critical mineral over-reliance on foreign sources and adversarial nations.

The domestic supply chain has to be bolstered by recapturing critical minerals, manufacturer materials, and components from this pile of used electronic devices.

This is vital for sustainability, manufacturing, and national security. Increasing the amount of domestically recovered minerals can immediately shore up the supply chain and bring manufacturing costs down.

Consumers are Trashing a Veritable Goldmine

1 ton of old mobile phones can yield around 300 grams of gold – far more than 1 ton of gold ore. A ton of ore will only give you 1 gram of gold, whereas you can get that from 35 mobile phones.

The government recognized this mineral storehouse as early as 2006. At that time, a government survey determined that 35 thousand pounds of copper, 772 pounds of silver, 75 pounds of gold, and 33 pounds of palladium could be recovered for every 1 million cell phones recycled that were recycled.

But consumers are still trashing gold, palladium, and other valuable rare minerals. Americans are said to throw out 120,000 laptops every day and between 350,000 to 416,000 cell phones per day – adding up to 151.8 million per year.

The US is said to generate 6.92 million tons of e-waste per year, with only 15% being recycled. Rather than enforce serious domestic recovery programs, the United States exports between 10 to 40% of its electronic waste, which generally becomes toxic waste in other countries.

Many Americans don’t trash their devices but don’t recycle them either. There are plenty of electronics hoarders around, just hanging on to old and obsolete devices.

Phone Arena, an online industry outlet, recently surveyed its users to see how many old phones they had around. 25% had 5 or more, 20% had 2, 17% had 3, 12% had 4, 14% had 1, and only 11% weren’t keeping any obsolete phones. And that’s a niche industry magazine with tech-savvy readers.

Hoarding typically happens for a few reasons:

- Security Concerns: consumers are unfamiliar with what happens to phones, laptops, and other recycled electronics,

- Lack of Awareness: consumers don’t know that recycling programs are available, or where to take them,

- Low Motivation: consumers don’t see any real need to recycle devices instead of keeping them around.

Recycling opportunities are available in many places. But consumers aren’t always making use of them. One way to boost recycling enough to recover critical minerals is to make device trade-ins more attractive.

In a country with high levels of economic and personal freedom, the end-users are the ones who will have to choose whether or not to turn their devices in for recycling and recovery.

Boosting Consumer Spending Power with Device Trade-Ins

Consumers who recognize the value of their old devices are raking in the cash. These trade-ins returned a whopping $784 million to US consumers in the first quarter of 2022 alone.

These numbers are staggeringly high and on the rise. The Q1 numbers show a 17% year-over-year increase from 2021. In that year, consumers received over $3.043 billion back in monetary value. They received over $2.117 billion in 2020. And over $2.378 billion in 2019.

The numbers are growing fast as consumer awareness of the importance of electronic recycling increases. Some have dubbed consumer willingness to sell old goods as “recommerce” – a niche trend seen across a variety of consumer markets.

But this needs to be more than a subculture. It needs to be mainstreamed for consumers so they can consumers still have more to give. This is where the business sector can step in.

Nurturing A Fledgling Trend

The private sector can offer the same device trade-in and buyback services that Apple, Samsung, and other brands used to attract customers and persuade them to upgrade.

This is an ideal way for businesses across the consumer electronics sector can put more money in their customers’ pockets and incentivize them to spend.

It’s an ideal time for new service providers to enter the market. Consumer awareness is growing, the public values electronic recycling, and most people have plenty of devices to turn in.

Billions of dollars worth of business are already being done. And yet, this represents a fraction of what’s available. One estimate is that around 550 million phones are waiting to be recovered nationwide.

Those phones and other devices are valuable to you whether they’re last year’s flagships, 3 years old, or completely obsolete relics.

Along with the environmental benefits of recovery, trade-in programs offer customers easy financing to put towards new purchases. A consumer who is a few hundred short on acquiring a new device can be encouraged to make a new purchase by receiving cash for old electronics or having credit applied to new purchases.

Most electronics customers are already familiar with these programs and ready to use more of them. These consumers have let the industry know what they want. Consumers want trade-in programs that are secure, accessible, and easy to use.

You can provide them this convenience by making trade-ins available where they already shop and do business. In-house buyback programs increase sales with existing customers and attract new ones.

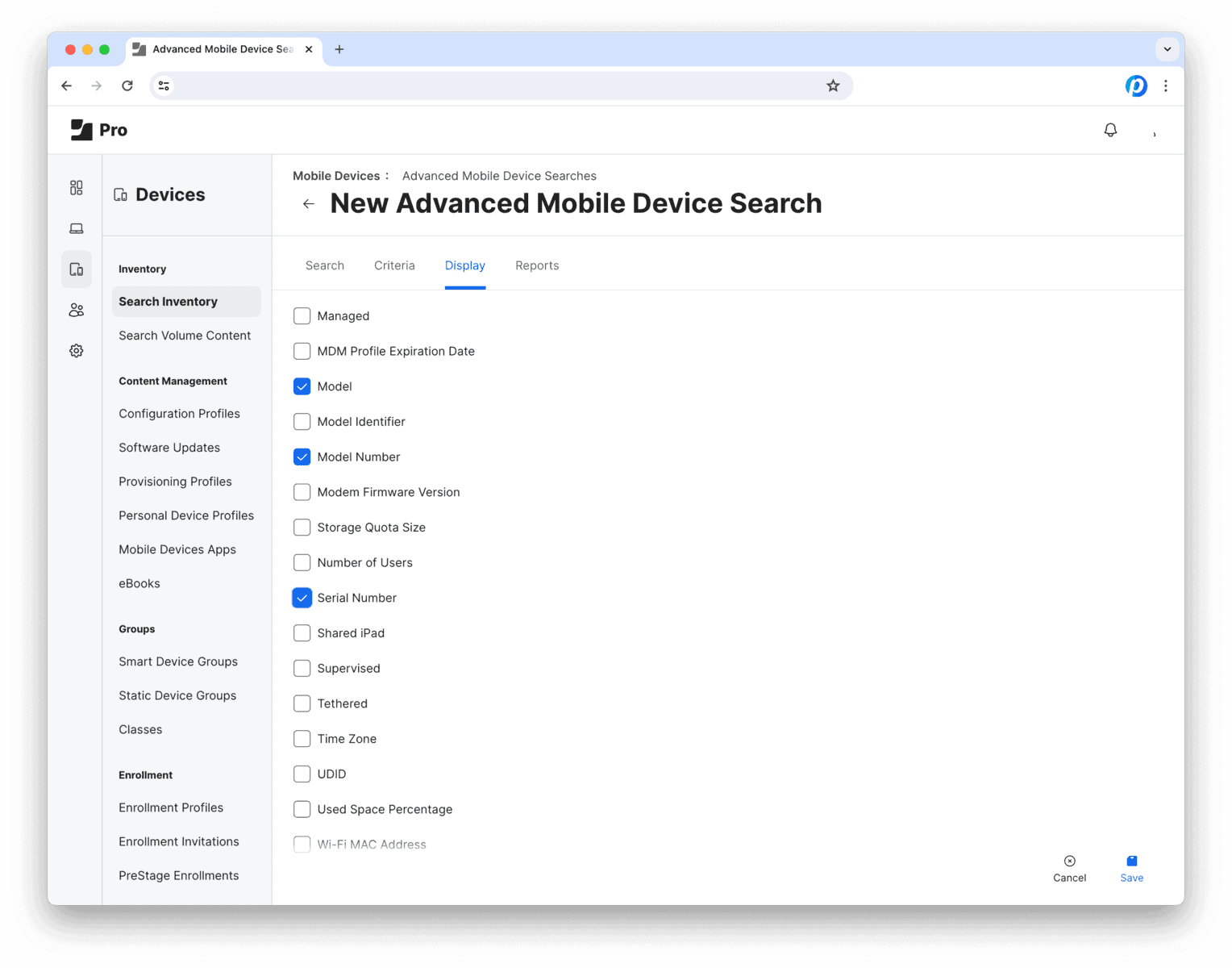

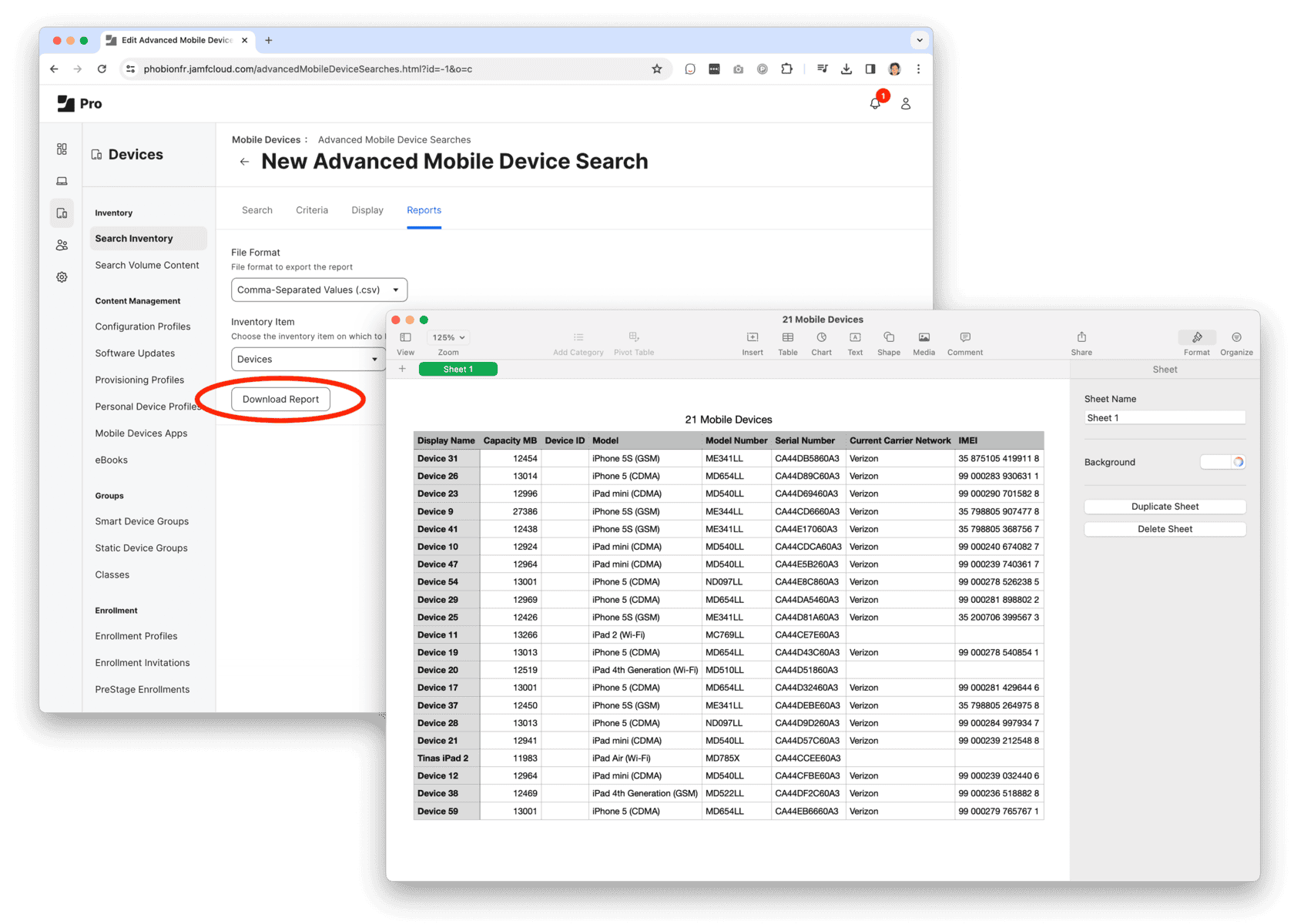

You can offer this with a program provider like Phobio.

Run Your Own Trade-In and Buyback Program with Phobio

Phobio powers in-store, online, bulk buying, and individual resale trade-in programs. We offer best-in-class service and consumer security, and are trusted by some of the world’s greatest brands.